|

|

| Help | |

| You are here: Rediff Home » India » Business » Special » Features |

|

| ||||||||||||||||||||||||||||||||||||||||||||

|

| ||||||||||||||||||||||||||||||||||||||||||||

Life Time Super Pension (LTSP) invests premiums (minimum of Rs 12,000), net of all charges, in your chosen fund till the time you want your pension to start. This is called the accumulation phase and can span 10-57 years. The age at which the pension starts, the vesting age, can be 45-75 years. The entry age is 18-65 years.

In this plan, a policyholder can forego life cover and, hence, pay no mortality charges. It's better to take a zero life cover. On death during the accumulation phase, the nominee gets the fund value and the policy ends.

If one wants to keep life cover, the minimum cover would be between Rs 1 lakh (Rs 100,000) and the annual premium multiplied by the policy term. On death, the nominee gets the higher of the sum assured or the fund value. The spouse can use the proceeds to buy annuity immediately.

Options during accumulation phase. First, you have to decide the annual premium and the vesting age. Till vesting age, premiums are invested in one or more of six fund options.

The composition of these can be changed any time. Ideally, go for the growth fund option during the initial years and move to less riskier options as you get closer to the vesting age.

Options at vesting age. There is no option to get the full accumulated sum at vesting age. The most you can get as a lumpsum is a third of the fund value, tax free. On the remaining two-thirds, the insurer starts paying you regular pension based mainly on the then prevailing interest rates.

If you find the pension amount less than market rates, you may transfer the remaining corpus to another insurer at no cost.

Early exit. Since LTSP is a long-term plan, avoid early exits. If you don't want to exit, but wouldn't like to pay regular premiums, you can stop doing so after the first three years.

Early exit. Since LTSP is a long-term plan, avoid early exits. If you don't want to exit, but wouldn't like to pay regular premiums, you can stop doing so after the first three years.

Life cover, if chosen, would continue and the funds invested would grow till vesting age and then pension would be paid. Full exit at no penalty is allowed after five years.

Costs. In LTSP, the total premium allocation charge (PAC) on annual premiums less than Rs 20,000 over 10 years is 3.70 per cent of the total premium paid.

On premiums higher than that, the cost reduces by 3-6 per cent. The PAC is nil after the 11th year for all amounts. The policy administration charge of Rs 40 per month is applied on the fund value all through the term of the policy.

Performance. This is one of the few insurers to put most of the funds and investment-related information on its website. It sends portfolio details to customers every quarter and updates monthly disclosures on its site.

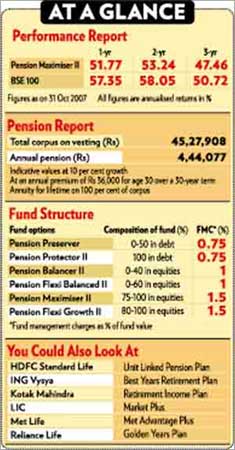

Apart from the latest NAVs, one may also look at past performance of funds vis-a-vis the benchmark, and actual returns of a fund. As on 31 October, the Pension Maximiser Fund was 91.03 per cent exposed to equity. It had invested in more than 10 sectors, with about 52 per cent in capital goods, finance, and software.

What to do. Any fund needs to at least beat the benchmark consistently to give a reason to invest for a long term. LTSP hasn't done so yet (see At A Glance). If invested, you should continue paying premiums unless you are in dire financial straits, even though you can continue the policy without regular payments after the first three years. Exit will be costly.

If you let the policy run for 10 years or more, the retirement corpus will grow and your average cost of holding falls.

More Specials

Powered by

|

|

| © 2007 Rediff.com India Limited. All Rights Reserved. Disclaimer | Feedback |